Voice Search and Its Impact on Consumer Decisions for Financial Institutions

As consumers make decisions that affect their well-being, regardless of whether these are for mental, physical, emotional, or financial health, they may instinctively turn to the Analytical decision-making style. In this case, the decision maker likes to make choices only after careful consideration of all available inputs and potential outcomes. As consumers gather these inputs, it is important to understand how they are gathered as this creates an opportunity to intersect the process with strategic marketing and communication efforts to influence their decisions. Historically, consumers would often consult friends, family, and colleagues for opinions and advice. More recently, social media has become a more important source for this type of solicitation. Another area that is rapidly changing is how consumers use search engines, especially as they make financial decisions.

The use of voice search on smart speakers (ex: Amazon Echo and Google Home) and mobile voice assistants (ex: Apple’s Siri and Google Assistant) is growing. While typed searches remain more common than voice searches, we do see search behaviors evolving. In 2016, only 20% of Google App searches were done by voice compared to 2023 where almost 30% of Google App searches are voice searches. We anticipate the adoption of voice search will continue to rise as voice recognition technology improves and consumers become more comfortable using it.

How Voice Search is Used for Financial Research

Some of the ways consumers are likely to use voice search in the context of finances and banking include:

- Researching information on specific financial products or policies

- Getting answers to finance-related questions

- Comparing rates, ratings, or offers

- Locating nearby branches or ATMs

Voice Search Selection Factors

While Amazon and Google have not publicly disclosed how they choose to rank voice search results, the selection process is aimed at providing the most relevant and helpful information to users. Factors likely influencing selection include:

- Contextual relevance to the user query

- Perceived source authority and credibility

- Source inclusion in featured content/snippets

- Location-based cues

- User engagement signals (ratings, dwell time, click-through-rates)

SEO Optimization Strategies

With this trend in mind, there are ways financial institutions can improve their chances of being utilized in both smart speaker and mobile voice search results.

1. Optimize for Natural Language & Conversational Content: Many voice searches are asked in the form of a question or are conversational in nature. Website content that contains long-tail keywords used in natural speech, is easy to understand when read aloud, and that answers commonly asked questions is more likely to be featured in voice search results.

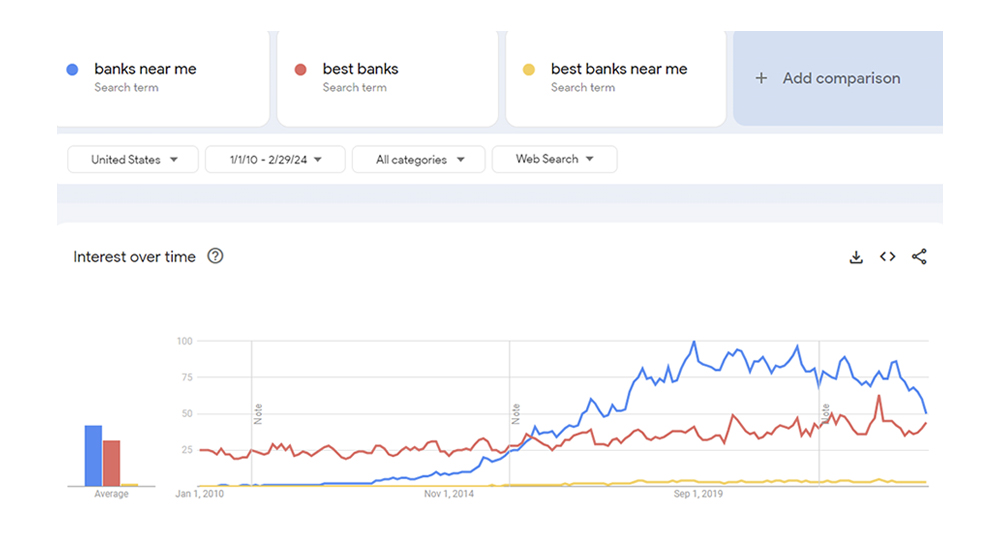

2. Local Search Engine Optimization: From July 2015 to July 2023, the number of “banks near me” searches grew 345%.

Having a verified Google My Business Listing, optimizing for local SEO (ex: Schema markup on location pages and consistent local citations), and using location-based keywords in paid search copy with local ad extensions can help improve visibility in both voice search results and Google’s “near me” searches.

3. Prioritize a Strong Mobile Experience: In addition to consumers performing the majority of voice searches on mobile devices, Google also factors a website’s mobile experience into its rankings for desktop searches. This makes having a website that is mobile-friendly (ex: loads quickly and responsive design) an integral part of any SEO strategy, not just voice search.

At present, voice search is primarily utilized by younger generations that grew up in the digital era. With this in mind, voice search optimization efforts are likely to have the strongest impact when focused on gaining ground in local map pack results or products of interest to Millennials and Gen Z (ex: first-time homebuyer programs or student checking accounts).

While younger consumers make choices in different ways and have differing criteria in defining a “good decision” we recognize that technology drives the mechanics of how they research their needs and make their decisions. As this audience grows in wealth, it will become increasingly important to leverage “voice search” to reach and influence this attractive constituency for financial institutions.